As private and public forces continue to drive clean energy development and energy transition in the United States, we continue to see Renewable Energy Credits (“RECs”) play an increased role in the transition. In order to remain competitive, it is vital to understand how the market functions and overall trends and how to optimize your portfolio properly.

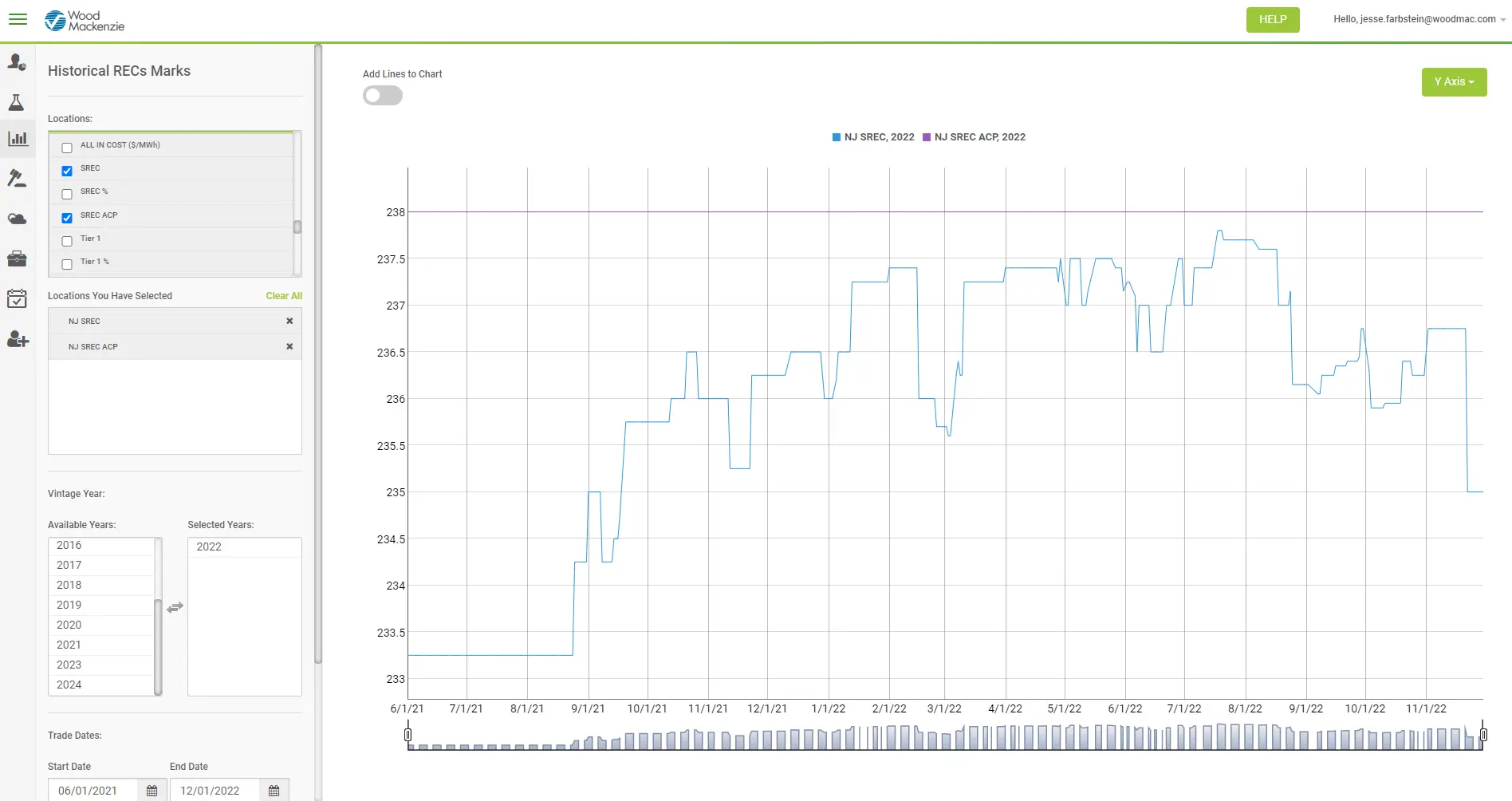

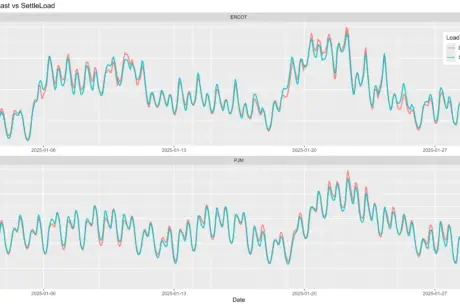

As the year draws to a close, as expected, we see significant trade volume in the Renewable Energy Credit (REC) sector across most major markets. In the PJM Market, we are seeing historically high pricing across the board following the close of NJ RPS Compliance as traders turn their attention to the April RPS compliance deadlines for the OH, MD, and DC Markets. As we’ve been predicting, the current market on the CY2022 and RY2023 PJM Tier I Complex (PA, NJ, MD) has continued to increase to around $28.00. This is likely due in part to the upcoming PJM load auctions and MD compliance deadline around the corner. The NJ SREC Market has shifted downward after the close of the RY 2022 compliance period as the ACP rate for NJ SREC decreases annually by $10.00. The current market for NJ SRECs should remain around $226.00 with an ACP rate of $228 for RY 2023. PJM Tier II Complex (PA, NJ) has increased since last week to around $19.00, significantly higher than the $13.00 average we saw a few months ago. This is likely due to compliance buyers and spec traders purchasing supply for future years.

The NEPOOL Class I Complex (CT, MA) has increased slightly to $36.25. MA SREC I and II production is down year over year and will likely keep prices high due to undersupply. ME Class II Market has increased over the past few weeks due in part to a legislative decision limiting Class II eligibility to generating units less than 100 MW.

The NYISO Voluntary Market has seen significant price increases from $16.25 a month ago to $18.50 today. This is likely the beginning of the upward swing we have been predicting over the past few months. The market is still likely underpriced given the summer droughts causing reduced Hydro production in NY State. We also continue to see significant NY exports to the NEPOOL market as the NEPOOL Class I Complex trades at a premium to the NY Market. This will cause supply to be limited in the NY Market unless we reach a price parody with New England. Based on these factors and the VACP increase from $23.79 to $35.00, we expect the NY Voluntary Market pricing to increase into 2023.

The National Wind and Any-Tech Market has held steady over the past week. However, as a retailer, it is still likely a good time to buy to cover voluntary product needs as retailers and corporate buyers will enter the market Q1 2023 to cover 2022 obligations.

The REC market can be a difficult landscape to navigate, so please reach out to an expert with any questions regarding environmental commodities before you get started.

By Jesse Farbstein, Portfolio Manager, Wood Mackenzie Energy Management