It is no secret that temperature and precipitation are both extremely important indicators for the energy industry. Temperature is a primary driver of electricity demand due to heating in the winter and cooling in the summer. Precipitation correlates strongly with temperature and with output from both wind and solar generation.

As such, the temperature is probably one of the most important factors that are incorporated into electricity supply and demand planning, price forecasting, and both near- and long-term risk management decision-making.

You may not realize it, but there are a large number of different business use cases that require the use of weather and precipitation data within the energy industry. These use cases include:

- Short-term forecasting of power and gas prices to inform supply asset (thermal, wind, solar, hydro, etc.) bidding and near-term economic dispatch.

- Medium-term energy risk management relies on understanding statistical distributions of weather and their corresponding impact on market prices, asset dispatch, hedge performance, etc.

- Hedging energy portfolios using exotic weather derivatives that pay off relative to realized temperatures (or other weather patterns), rather than commodity prices. Examples include temperature derivatives, snowfall derivatives (ski resorts use these to hedge their risk of lost revenues due to lower-than-average snow years), and many others.

- Exploring the impact of rising temperatures in long-term and integrated resource planning (IRP) scenarios. This is more related to climate timescales than weather-related but is very important to maintaining grid reliability as supply/demand dynamics evolve amid rapidly changing climate conditions. Although avant-garde, this exploration is becoming more impactful with the consistently extreme heat we’ve been seeing in the last few years.

- Speculative power traders rely on accurate weather forecasts to take positions that they hope will pay off in the near-term (next hour to next few days). Having a good weather forecast is considered a competitive advantage in this case. Such trading activities include real-time and day-ahead power trading/scheduling as well as term trading (next month and beyond).

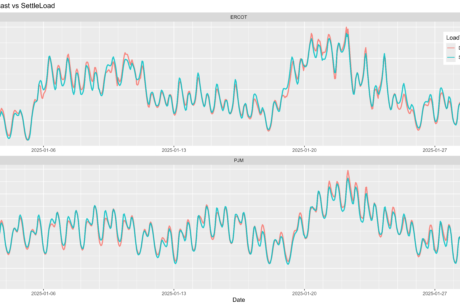

The covariant relationship between weather (primarily temperature) and load, weather and renewable generation, and weather and price need to be explicitly parameterized using coincident historical time series data (e.g., historical hourly market prices, realized hourly renewable generation, realized temperatures). These historically-parameterized covariant relationships can then be projected forward within simulations and can also be manually tuned by users for the purpose of scenario or sensitivity analysis.

Whether parameterizing these relationships from historical data, forecasting them using other modeling methodologies, or designing scenarios, the relationship between weather and these other risk factors is of primary importance to IRP modeling, cash flow forecasting, asset valuation, and other energy analytic use cases and absolutely must be incorporated into any energy analytic framework.

By: Brock Mosovsky, Co-Founder and VP, cQuant.io