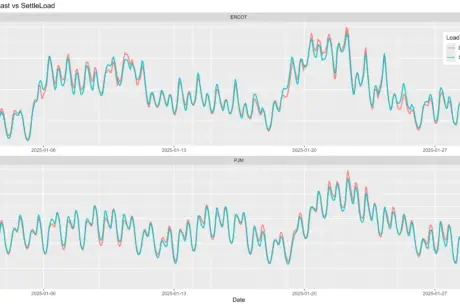

Energy retailers face working capital squeezes and unsecured credit exposures

TL;DR

- Energy retailers face increasingly stringent requirements to post security

- Energy retailers have limited options when securing and/or financing their own receivables

- Existing credit providers struggle to provide a comprehensive, streamlined solution

Rising commodity prices and changing credit requirements mean energy retailers are required to post ever-higher security to their wholesalers.

Whilst some retailers can access a level of unsecured credit, most market participants are forced to choose between posting Letters of Credit, Cash Collateral or Surety Bonds.

Increased security requirements lead to increased working capital costs, reducing retailer margins and creating higher energy costs for end-users.

In addition to the financial cost, retailers face a significant administrative burden in securing, posting, and amending the required security on a regular basis.

As competition has forced retailers to adopt technology and automation, established credit providers have struggled to keep up the pace.

Paper-based forms, manual processes, and even wet-ink signatures still prevail, creating needless inefficiencies reflective of the capital inefficient nature of existing solutions.

At the same time, with retailers understandably hesitant to request security or financial information from their own customers, there are limited options available for retailers wishing to secure or finance their own receivable base.

Trade credit insurance presents an imperfect solution, with its conditionality and loss adjustment processes preventing retailers from accessing balance sheet protection when they really need it.

Purchase of receivables programs allows retailers to reduce non-payment risk and somewhat alleviate working capital squeezes, albeit at a significant cost.

There is a clear and growing need for energy retailers to be able to access investment-grade, capital-efficient security that can be deployed in real-time.

Existing options for retailers to post security and secure their own balance sheets lead to needless working capital squeezes and create a significant administrative burden.

There are now alternative forms of credit security for Retailers. They are on-demand payment bonds that have been developed specifically for the downstream energy market and have been adopted by global blue-chips, including BP and FleetCor. Backed by ‘A-rated’ insurers, they can be secured, adjusted, and claimed in real-time and are 100%, non-cancellable cover, empowering credit teams to post security without any requirement for collateral and to realize total balance sheet protection when extending credit. Giving Retailers the capital they need.

By: Charlie Evans – Chief Commercial Officer, BondAval