Why we’re seeing fraud in the energy space

Energy deregulation and a focus on growth have led energy companies to embrace signups through various channels, including third-party brokers/affiliates and state-sponsored electric choice websites. These channels increase customer acquisition, but reduce the level of control energy providers have people stealing from utilities and over who gets signed up and how they’re signed up. Affiliates and brokers may be incentivized to maximize signups, whether they’re legitimate or not.

Why do energy providers see so much fraud

In the energy industry, as elsewhere, fraudsters employ various techniques.

One common MO involves exploiting referral programs. Fraudsters use stolen or synthetic identities to fraudulently sign up new accounts, collecting referral bonuses or rewards for signing up “new customers” who will never actually pay for service.

Another approach focuses on regions where consumers have a large number of options when it comes to energy providers. Here’s how it works:

- Fraudsters offer consumers several months of power for a small fee.

- Fraudsters use stolen identities to sign up for an account with an energy provider, which is then linked to the consumer’s address.

- Neither the fraudster nor the consumer pays the energy company for the power. Typically, it takes several months before an energy company disconnects the consumer’s address.

- When the consumer receives a disconnection notice, they contact the fraudster, who repeats the process with a different energy provider.

Some fraudsters also target energy companies, scamming power utilities is a way to get free electricity for themselves, or to leverage credit or payment plans they couldn’t access with a low credit score.

Preventing Fraud in Energy

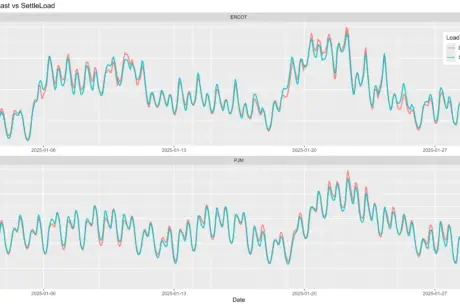

Catching fraudsters at the point of application is possible. Fraudulent applications often contain identifiable patterns that allow them to be flagged as high-risk, especially if companies are able to leverage third-party tools or data to obtain additional signals when assessing applications.

Energy providers should also be conscious of the varying risk levels associated scamming power utilities, with fast-growth-optimized acquisition channels. We’ve observed significant differences in fraud rates across various acquisition channels and sub-brands in the utility space.

To combat fraud effectively without hampering growth, energy providers should embrace fraud strategies that combine third-party risk signals with known internal risk factors and operations insight to design tailored acquisition strategies for each channel.

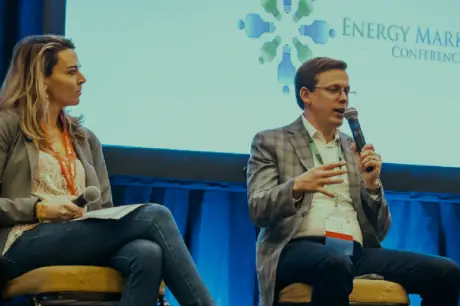

To learn more about fraud challenges in the energy space and potential solutions, attend SentiLink’s pre-conference session at EMC 22 in Las Vegas: “Predictive Risk Models in Action: Safeguard Across Acquisition Channels” Monday, September 23, 4:10-4:40 pm in Room Julius 1-4. If you’d like to schedule a meeting with SentiLink at the event, click here.