Photo courtesy of Weather.com

In February 2021, a large portion of the United States was impacted by Winter Storm Uri which brought snow, ice and punishing cold to the center of the country, triggering electricity and natural gas price spikes across a number of states. The public narrative after Winter Storm Uri has generally been “customers receive exorbitant bills due to unscrupulous retail energy companies charging excessive prices”. The implication being that residential consumers directly bore the costs associated with the high energy prices because of retail competition and that this would never happen under a regulated monopoly construct. However, looking a level deeper demonstrates that very few residential customers served by competitive suppliers experienced increased energy bills due to the storm, and that, in the vast majority of cases, competitive suppliers, and not their customers, absorbed the prices thereby losing hundreds of millions of dollars. On the other hand, customers being served under a regulated utility construct are not protected from the storm’s financial impacts and will in fact, be paying the costs associated with the storm for many years to come.

During the storm, the price of natural gas increased to as much as 628 times normal in the worst-affected trading hub in Oklahoma.[1] This drove a surge in wholesale electricity prices as well since the sector increasingly depends on natural gas to generate electricity. Unlike the natural gas market, prices in wholesale electricity markets are capped by regulation. In the Electric Reliability Council of Texas (ERCOT) market, prices remained at the $9,000 per megawatt-hour (“MWh”) price cap for days, about 415 times normal pricing levels.[2] To put that in perspective, if these prices were passed on directly to a residential customer for a single day their February commodity bill for gas would increase from $3.80 per day to $2,386.40 per day[3] and their commodity bill for power would increase from $0.74 per day to $308.44 per day.[4]

During and after the Winter Storm, news coverage of ratepayer impacts tended to focus on Texas for two reasons. First, the state’s electrically isolated ERCOT market was the epicenter of power outages. Second, a small segment of residential customers in Texas had signed up for rate plans that linked their bills directly to the surging wholesale market. The fact that less than 1% of ERCOT residential customers comprised this segment did not deter the headlines. In truth, however, most Texas residential customers were served through competitive fixed-rate contracts that automatically “insured” them against Uri price spikes. As a result, the brunt of surging prices caused by Uri was borne not by customers but by the retail suppliers that served these customers or their wholesale suppliers. Shareholders ultimately bore that risk, and many suffered huge losses. In addition, competition among retail suppliers has, thus far, prevented retailers from increasing prices for the purpose of recouping past losses.

In contrast, customers in nearly every other affected state will eventually pay all or nearly all costs associated with the storm. That is because these customers are part of a captive base of consumers fixed to a particular monopoly utility’s service territory. The recovery of fuel price spikes from these customers largely has been treated as a given. Unlike the competitive retail market, where fixed-rate contracts prevent the subsequent collection of unexpected losses, utilities have applied for and are expected to receive cost recovery for all their losses (sometimes even including a profit margin). The consequence is that, with few or no exceptions, utility monopolies will experience essentially no financial consequence due to the winter storm’s fuel price shocks.

At least 67 utilities are seeking storm-related recovery of at least $14.5 billion[5] of principal alone, to be paid by ratepayers, with residential customers paying an estimated 58% of that total. These utility monopolies seek not only to recoup losses at their customers’ expense,, but, in at least some cases, also to charge their rate of return on the losses until they have been recovered, thereby transforming what in a competitive industry would constitute massive financial losses into a profit center.

Meanwhile, although Texas has come to be identified with a fully competitive energy market, it is not. On the contrary, the natural gas utility sector for residential customers in Texas consists entirely of utility monopolies. These entities have applied to their regulator to recover all their extraordinary costs. Additionally, Texans living in Austin, San Antonio, certain other cities, and in rural areas have no choice in electricity provider. The losses the municipal and co-operative utilities experienced during the event also will be entirely recovered from their fixed base of consumers, with the possible exception of Brazos Electric Co-operative, which through bankruptcy is seeking to discharge some of its debts.

Very limited avenues are available to competitive suppliers to recoup past losses. In Texas, the state legislature authorized ERCOT, the operator of the electric grid covering the vast majority of the state, to obtain a securitization of $2.1 billion for costs related to ancillary services and uplift costs during Winter Storm Uri. Proceeds of this financing may be claimed by all load-serving entities, including both regulated and competitive suppliers. Even assuming some of these costs, as well as the costs of wholesale-indexed and variable-rate retail products, are passed to residential customers, the comparison between competitive and utility-monopoly markets is stark. Competitive supply customers will pay far less Winter Storm Uri related costs on average than utility-monopoly customers will. The table below compares the average cost impact of Winter Storm Uri on competitive supply customers in Texas versus utility-monopoly customers in Texas and other impacted states.

Average Uri Costs Incurred per Residential Customer

| Entity Type | Average Impact of Winter Storm Uri per Residential Customer |

| Power Competitive Suppliers – Texas | $86 [6] |

| Power Utility Monopolies – Texas | $373 |

| Gas Utility Monopolies – Texas | $450 |

| Power Utility-Monopolies – All Uri Impacted States | $326 |

| Gas Utility-Monopolies – All Uri Impacted States | $381 |

[1] Daily gas prices for OneOK rose to $1,193/MMBtu compared to an average of $1.85/MMBtu for the previous three Februarys.

[2] This multiple is derived by dividing the ERCOT cap price of $9 per kWh during Winter Storm Uri by the average of ERCOT LMP at the Houston Zone for the three past February periods prior to 2021.

[3] Assumes residential customer uses 2 Mcf per day with an EIA conversion factor to MMBtu of 1.037. https://www.eia.gov/tools/faqs/faq.php?id=45&t=8#:~:text=One%20thousand%20cubic%20feet%20(Mcf,1.037%20MMBtu%2C%20or%2010.37%20therms.

[4]Assumes residential customer uses 959 kWh per month.

[5] Not all utilities seeking relief identified the amounts sought. As such, $14.5 billion is a conservative estimate of the minimum that will be recovered from customers.

[6] This value is derived by adding $72 residential customers are expected to pay for ERCOT Securitization HB 4492 plus cost increases residential customers already paid in February 2021 above and beyond what they normally paid in the last three Februarys prior to the storm.

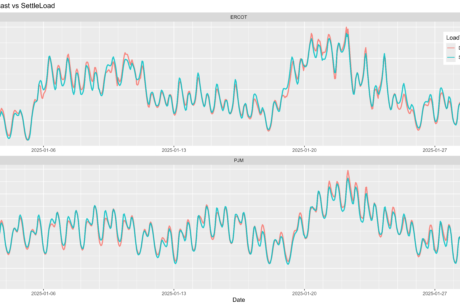

By: Guy Sharfman is Vice President of Market Analytics and co-founder of Intelometry, Inc.