The energy sector is seeing a huge gap between its top performers and every other provider. The latest data on total shareholder returns within the industry find that top companies have twice the revenue growth at a 30% gap from bottom performers.

The clean tech subsector leads this revenue uptick, with its top performers creating ten times the value of the market index. Oil and gas providers utilizing clean energy outperformed by 400%. Cost and revenue management has been the key to success for market leaders, but automation may well be the new solution that maintains this edge.

Revenue management in energy

To understand the most effective principles in the energy industry, one need only look at the biggest energy companies in the world in terms of revenue. PetroChina leads the pack with $374.91 billion, closely followed by Sinopec and Saudi Aramco. As China’s biggest gas and oil provider, the top performer earned $11,888 every second in 2021.

Despite the decline in oil and gas, PetroChina also got record profits in 2024. This is achieved by analyzing the curve in supply and demand. Along with its fellow top providers, revenue is effectively protected by preparing cost and profit margins depending on various potential scenarios. By optimizing operations and resources, variable demand and value no longer become as detrimental to a company’s ability to stay afloat.

Part of why clean energy is, as a whole, in the lead is that it uses sustainable materials. This allows for a product and business model that is inherently more resilient in times of change. While other economic factors may force supply chain issues for companies that sell traditional forms of energy (which then impacts revenue), solar and wind energy providers can face instability with more security.

Automation for revenue recognition

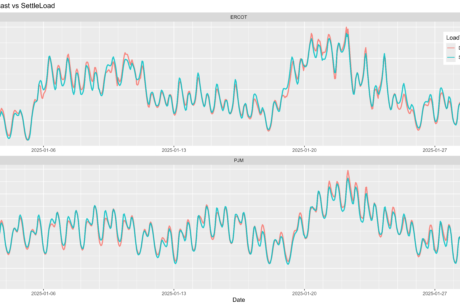

The digital transition, coupled with the move to sustainability, has made the energy sector much more prone to fluctuation. In addition to shifts in the supply chain, various regulations have changed the way revenue is handled. The main concern here is how the energy sector can maintain its foothold with consumers while accurately applying its strategy for accrual accounting.

As such, tools that automate the process of revaluation of variable consideration, complex contract modifications, and significant finance components have been needed. Promising solutions have come in the form of Softrax’s revenue recognition software, which utilizes automation for these processes and achieves compliance with constantly changing regulations. Unprecedented change can be stifling for energy companies dealing with PPAs and other long-term contracts, so automated systems can make it much easier and safer to remain within industry standards for financial reporting.

Since such automated software also uses a multi-tenant cloud, complex regulations can be immediately deployed into accounting without spreadsheets and workarounds. Energy providers often must operate by quarter, so automation simplifies the transfer from consumer to provider without disrupting cash flow and analytics-based market predictions. This also helps inform the provider how best to capitalize on any global variance.

The potential of AI for the energy industry

Automation solutions are already quite robust, but there is also further potential in integrating artificial intelligence (AI). Predictions of AI-powered energy markets are already slowly coming to fruition, with automated platforms like Ogre and C3 already being deployed in energy management. As we discussed in a previous Energy Marketing Conferences piece, predictive analytics are being developed to potentially detect anomalies in companies’ customer campaigns for retail energy, as well as personalized energy use and costs. There are even hopes of predicting customers with high risks of disconnection due to payment behavior and history.

In utilities, Latitude Media reported that 74% of companies are already exploring generative AI. Initial applications have been safer by sticking to customer service interactions. Still, increasing interest has also been in its potential for automating microgrid operations, battery maintenance, smart meter tech, and future load modeling. Although a huge chunk of the industry has displayed interest, only 27% have actively implemented such technology.

Cost and safety have been the primary barriers to adoption, but automation is one of the industry’s most promising solutions for revenue management. Automated tools allow energy providers to optimize their operations and supply while simplifying their accounting numbers. As tasks become more efficient and streamlined, the future looks brighter for the world’s energy suppliers, both established and new.

By: Jamie Lingerfelt for energymarketingconferences.com