As the EMC23 event unfolded, industry leaders gathered to discuss the future of energy management and the critical role forecasting plays in stabilizing power suppliers amidst increasingly unpredictable weather patterns.

Between plummeting temperatures and surging demand, the recent arctic blast that swept across the Northeast serves as a stark reminder of the imperative nature of accurate forecasting models. The stakes are particularly high for power suppliers, whose success in managing volatility rests on decisions made days and weeks prior to such events. For instance, during extreme weather conditions, real-time prices in the Electric Reliability Council of Texas (ERCOT) market can spike to nearly $2,000 per megawatt hour — roughly 40 times the normal rate.

This level of volatility presents suppliers managing large customer portfolios with difficult choices. For them, even minor forecasting errors can culminate in millions of unexpected costs. This challenge is underscored by data from the National Oceanic and Atmospheric Administration (NOAA), which indicates that 2024 was the fourth-costliest year on record for weather-related disasters, only trailing years like 2017, which saw damages of $395.9 billion.

Moreover, insights from Climate Central indicate that a staggering 80% of major U.S. power outages from 2000 to 2023 were weather-related, underlining the essential need for sophisticated forecasting capabilities. This necessity is particularly pronounced during extreme weather events when the financial stakes reach their zenith.

Understanding the intricate dynamics of regional power markets adds another layer of complexity. Suppliers operate like tightrope walkers, balancing the need for securing supplies across diverse regional markets. The day-ahead market, while providing more stability than real-time markets, still carries significant risk during weather extremes. Forward markets present the most predictability but are heavily reliant on long-term forecasting to optimize hedging positions correctly.

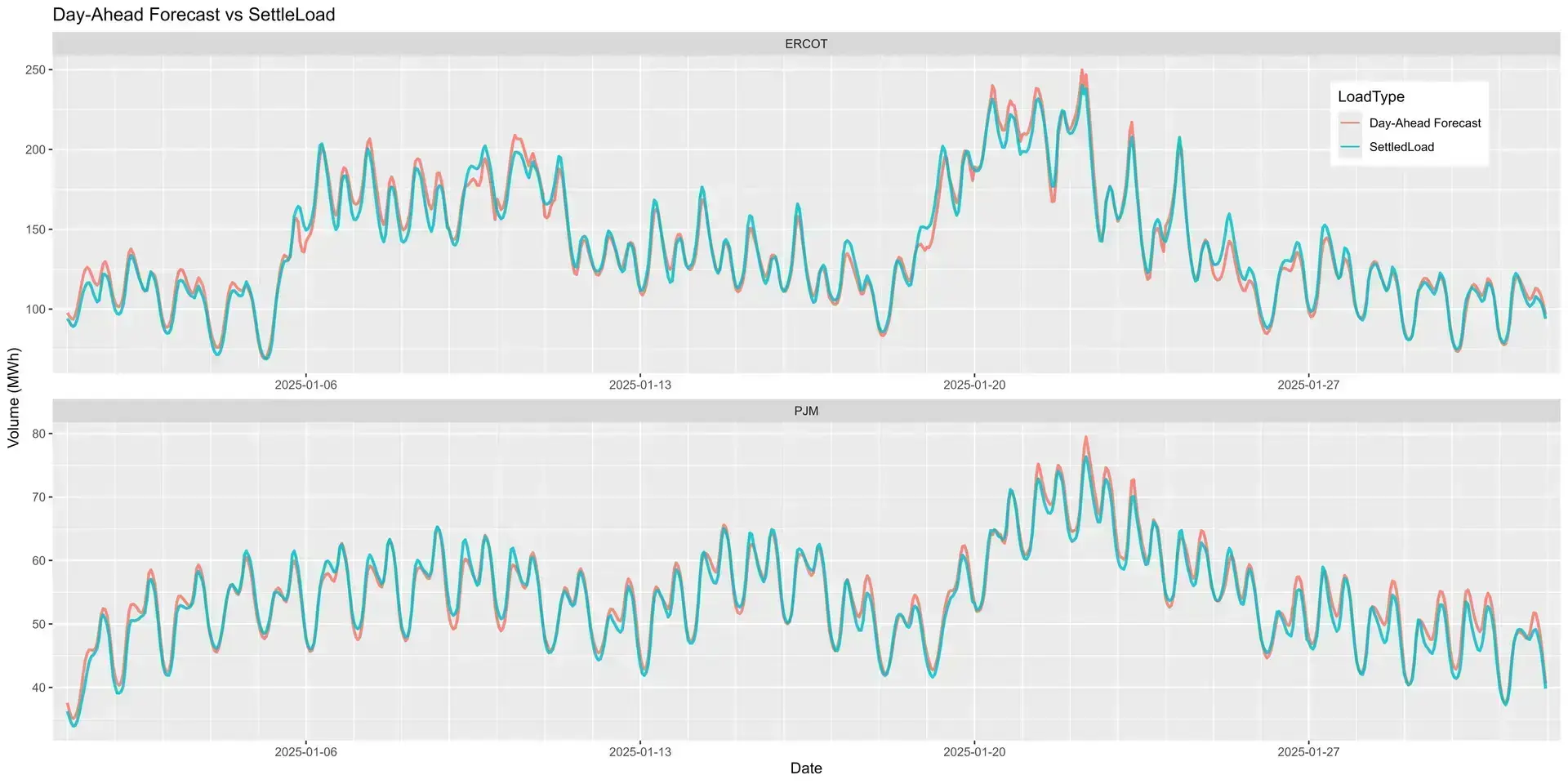

Data from POWWR highlights that the day-ahead and real-time price spreads during the January freeze varied from minimal differences of a few dollars to gaps exceeding $100 per megawatt hour. This variation exemplifies just the tip of the iceberg concerning regional market complexities. Each Independent System Operator (ISO) market introduces distinct challenges and strategies, further complicating the landscape for power suppliers.

For example, suppliers in ERCOT have the option to extend hedges into real-time settlements, adding a layer of flexibility. In contrast, markets such as PJM and ISO New England generally settle hedges against day-ahead prices. The unique forecasting challenges in ISO New England due to constrained access to detailed generation data contrast sharply with Texas, where advanced smart meter infrastructures provide nearly real-time consumption data.

As participants at EMC23 delved into discussions, the shared knowledge and experiences will equip suppliers with insights and strategies to navigate these complexities. The lessons learned from recent events and the evolving market dynamics underscore that accurate forecasting is no longer just beneficial; it’s an indispensable part of ensuring supplier stability and market success.

The growing frequency and severity of extreme weather conditions demand a renewed focus on refining forecasting tools and models. Suppliers who master the art of precision forecasting will emerge as leaders in their field, well-positioned to adapt and thrive in an era characterized by uncertainty. EMC23 represents a pivotal opportunity for the energy management community to forge ahead with innovative solutions that address these pressing challenges.

By: Jo Forsdike, POWWR