Renewable energy is at the forefront of global efforts to combat climate change and reduce carbon emissions. Optimizing compliance with standards can be challenging for electricity providers.

Various mechanisms and standards have been developed to promote the adoption of renewable energy sources, yet many providers still only see compliance as a burden due to antiquated or nonexistent REC management strategies. In this article, we provide guidance on how to harness renewable standards to forge a path towards sustainable success.

Background

RPS and CES: Renewable Portfolio Standards (RPS) are policies that require energy providers to supply a certain percentage of their electricity from renewable sources. These standards aim to diversify energy resources, promote domestic energy production, and reduce greenhouse gas emissions.

As of 2024, 29 states and the District of Columbia have implemented RPS, with targets ranging from 50% to 100% renewable energy by 20501. Clean Energy Standards (CES) are similar to RPS but include a broader range of low-carbon energy sources, such as nuclear power and advanced fossil-fuel technologies with carbon capture and storage. CES policies aim for 100% clean electricity, with several states adopting these standards alongside or in place of RPS.1

RECs: RECs represent the environmental benefits of generating one megawatt-hour (MWh) of electricity from a renewable source. They are used to track and trade renewable energy production, allowing companies to claim renewable energy use even if their physical electricity comes from non-renewable sources. RECs incentivize renewable energy projects and support compliance with RPS and CES policies.2

Challenges & Opportunities

The trading of Renewable Energy Credits (RECs) has become essential in the energy market, helping companies manage their environmental impact and achieve sustainability goals. For electricity providers, RECs are crucial for meeting regulatory requirements.

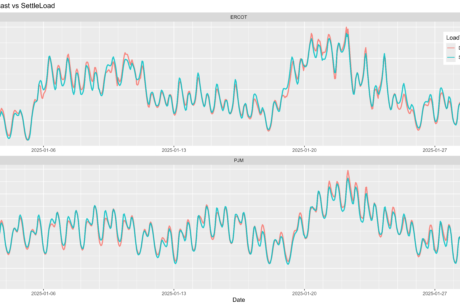

One challenge associated with managing these credits can be the complexity of varying state standards and requirements. Additionally, the number of RECs needed depends on the energy load, making accurate reporting vital. This involves integrating data from various systems, such as load forecasts, state-specific REC requirements, and previously acquired RECs.2

Another challenge is that many market participants rely on spreadsheets and manual processes for tracking purposes. There are more off-the-shelf solutions available now than there were 10 years ago, but these can be costly and may still require extensive customization as well as integration with existing systems.3

However, modern trading platforms and risk management solutions have simplified these tasks, providing the necessary transparency and efficiency. These tools help companies navigate the complexities of renewable energy compliance, ensuring they meet regulatory standards and optimize their energy strategies.3

To succeed, companies must invest in the right tools to:

- Align REC pricing with customer contract costs

- Match the quantity of RECs purchased with compliance needs, avoiding costly overbuying or underbuying

- Accurately track RECs purchased and retired in both market portals and internal systems

- Ensure accurate RECs calculation based on customer’s load and location

- Consider the more complex voluntary REC requests from sustainably minded customers.

It is essential that companies do a comprehensive analysis of their needs and budget when choosing their management tools and staying up to date with any changes in compliance requirements in the market.3

Looking ahead

Renewable energy standards and instruments are essential tools in the transition to a sustainable energy future and as standards continue to evolve, electricity providers need to invest in appropriate tools and technologies for tracking, trading, and managing renewable energy instruments.

By doing so, they can ensure compliance with regulatory standards and optimize their energy portfolios.1 Also, by understanding and analyzing policies like RPS, CES, and RECs, other companies can contribute to reducing carbon emissions and promoting the growth of renewable energy.2

Other options are to invest in cutting-edge technologies and partnerships that enhance grid integration and energy storage solutions. Leading and contributing to these initiatives can drive significant advancements in the renewable energy sector and ensure a more sustainable and resilient energy future.3

References

1 https://www.eia.gov/energyexplained/renewable-sources/portfolio-standards.php

2 https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs

3 https://www.energycodes.gov/state-status/state-certifications

Author: Zaid Alhilo, Consultant, CAPCO