Introduction

In the rapidly evolving landscape of the Retail Energy industry, the imperative for efficient, real-time communication is undeniable. The transformative potential of Application Programming Interfaces (APIs) is evident across various industries, with Commercial Insurance being a prime example of significant strides made through API adoption. Bold Penguin, a leading insurance technology company, stands out in this regard, having catalyzed a paradigm shift in how insurance carriers connect with prospects, setting a benchmark for Retail Energy to emulate.

The Case for API-Based Communication in Retail Energy

Learning from Commercial Insurance

Bold Penguin’s innovative use of API integration has reshaped the Commercial Insurance landscape, enabling the creation of custom interfaces that facilitate direct connections between agents and brokers. This has expedited the quoting and policy binding processes, showcasing the profound impact of API-driven communication. The Commercial Insurance industry’s growth has nearly doubled since Bold Penguin began advocating for API-based communications within a Hub-and-Spoke model, underscoring the transformative power of this technology.

Commercial Insurance Retail Energy

Streamlining Operations

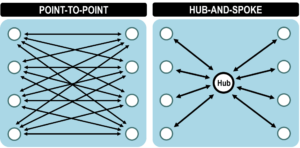

Retail Energy’s prevalent communication methods, characterized by cumbersome back-and-forth dialogs between brokers and suppliers, often results in protracted pricing request turnarounds, sometimes taking days or even a week to complete. APIs promise to rectify this inefficiency by providing a secure, central hub for data exchange. This singular connection point dramatically simplifies interactions, reducing potential connection from millions to a few thousand (think 200 suppliers connecting individually to 2,000 brokers = 4,000,000 connections; versus a hub and spoke structure which would only require 1 API connection for each of the 200 suppliers and 1 API connection for each of the 2,000 brokers, or only 2,200 connections.)

Standardizing Processes for Innovation

The absence of uniform processes for commodity deals in Retail Energy is a formidable obstacle to innovation. The introduction of new products and services, such as Renewables and Carbon-Free Energy quotes, is hindered by the current, disjointed approach. APIs can serve as the industry’s “common language,” simplifying the deployment and management of innovative offerings.

Focusing on Strategic Relationships

The extensive use of spreadsheets and emails for communication in Retail Energy is not only inefficient, but also detracts from the core focus of fostering strategic relationships with Channel Partners and Customers. The shift to API-based communication can automate mundane tasks, thereby reallocating precious time for strategic dialogues and enhancing customer engagement.

Conclusion

Embracing API-based communication in Retail Energy transcends mere technological advancement; it represents a redefinition of business operations. Drawing inspiration from the Commercial Insurance sector, Retail Energy can revolutionize its processes, standardize for innovation, and concentrate on cultivating robust relationships with partners and customers. In a competitive marketplace, the adoption of API-based communication is not merely an option, but an imperative for sustained growth and success.

By: Jason Beck, VP Sales, Enerex